Cost Volume Profit Analysis CVP

Azi in istorie

Perhaps the greatest danger lies in relying on simple CVP analysis when a manager is contemplating a large change in volume that lies outside of the relevant range. However, the higher the number, the higher the risk, because a higher DOL also means that a 1% decrease in sales will cause a magnified, larger decrease in net income, ultimately decreasing its profitability. In addition, companies may also want to calculate the margin of safety. This is commonly referred to as the company’s “wiggle room” and shows by how much sales can drop and yet still break even. Therefore, to earn at least $100,000 in net income, the company must sell at least 22,666 units. Datarails is a budgeting and forecasting solution that integrates such spreadsheets with real-time data.

CVP simplifies the computation of breakeven in break-even analysis, and more generally allows simple computation of target income sales. It simplifies analysis of short run trade-offs in operational decisions. In conjunction with other types of financial analysis, leaders use this to set short-term goals that will be used to achieve operating cost volume profit meaning and profitability targets. Contribution margin is the amount by which revenue exceeds the variable costs of producing that revenue. CVP analysis shows the relationships among a business’s costs, volume, and profits. This is best illustrated by comparing two companies with identical sales and profits but with different cost structures.

These are linear because of the assumptions of constant costs and prices, and there is no distinction between units produced and units sold, as these are assumed to be equal. Note that when such a chart is drawn, the linear CVP model is assumed, often implicitly. In the above graph, the breakeven point stands at somewhere between 2000 and 3000 units sold. For FP&A leaders this method of cost accounting can be used to show executives the margin of safety or the risk that the company is exposed to if sales volumes decline.

Cost-Volume-Profit Analysis: Explanation

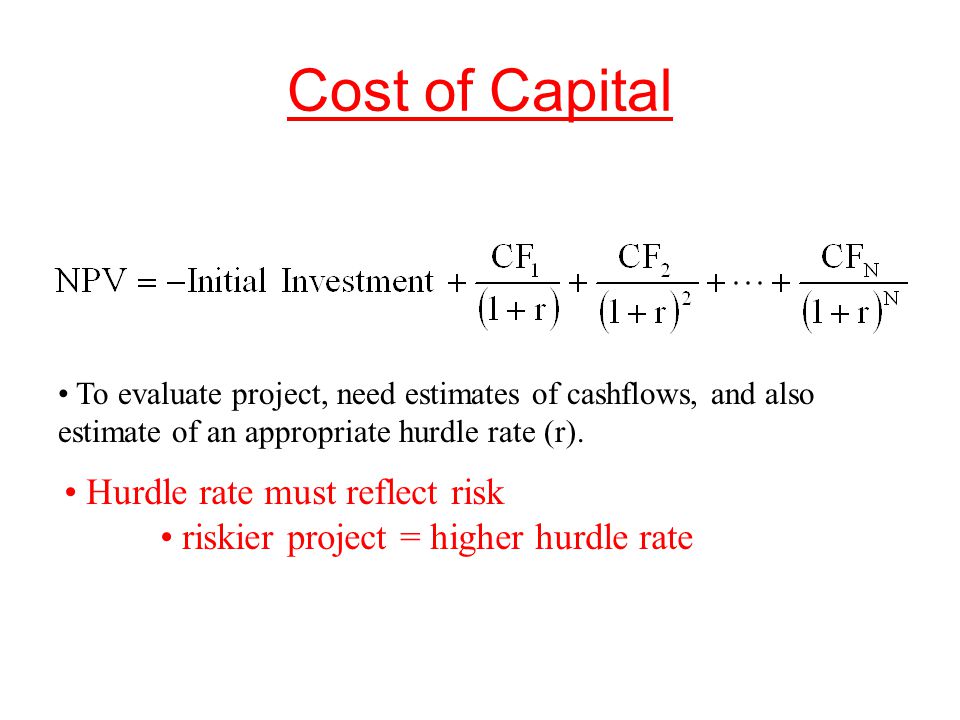

In the context of the

Basic Profit Equation, target costing sets a goal for profits, and solves for

the unit variable cost required to achieve those profits. The design and

manufacturing engineers are then assigned the task of building the product for

a unit cost not to exceed the target. Hence, setting the sales price comes last in the traditional approach,

but it comes first in target costing. Because most companies sell multiple products that have different selling prices and different variable costs, the break-even or target profit point depends on the sales mix. Breakeven analysis shows the effect of increased investments in fixed assets that lower variable costs but increase fixed costs. The contribution margin is the total revenue minus all variable costs.

Mallinckrodt plc Reports Second Quarter 2023 Financial Results … – PR Newswire

Mallinckrodt plc Reports Second Quarter 2023 Financial Results ….

Posted: Wed, 09 Aug 2023 10:45:00 GMT [source]

The cost volume profit chart, often abbreviated CVP chart, is a graphical representation of the cost-volume-profit analysis. In other words, it’s a graph that shows the relationship between the cost of units produced and the volume of units produced using fixed costs, total costs, and total sales. It is a clear and visual way to tell your company’s story and the effects when making changes to selling prices, costs, and volume. The cost-volume-profit analysis, also commonly known as breakeven analysis, looks to determine the breakeven point for different sales volumes and cost structures, which can be useful for managers making short-term business decisions. CVP analysis makes several assumptions, including that the sales price, fixed and variable costs per unit are constant.

What is Cost-Volume-Profit Analysis for Single-Product Company?

Break-even analysis is concerned with determining the sales volume at which total revenue equals total costs so that profits are seen. The contribution margin ratio (often called contribution margin percent) is the contribution margin as a percentage of sales. It measures the amount each sales dollar contributes to (1) covering fixed costs and (2) increasing profit. This profit equation is used extensively in cost-volume-profit (CVP) analysis, and the information in the profit equation is typically presented in the form of a contribution margin income statement.

Toast (TOST) Q2 2023 Earnings Call Transcript – The Motley Fool

Toast (TOST) Q2 2023 Earnings Call Transcript.

Posted: Wed, 09 Aug 2023 06:30:24 GMT [source]

The point where the total costs line crosses the total sales line represents the breakeven point. This is the point of production where sales revenue will cover the costs of production. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs. Basically, it shows the portion of sales that helps to cover the company’s fixed costs.

Cost Volume Profit Analysis: Definition, Objectives, Assumptions, Limitations

Kevin has edited encyclopedias, taught history, and has an MA in Islamic law/finance. He has since founded his own financial advice firm, Newton Analytical. Each column represents a different scenario, with the first column showing the base case and the remaining columns providing answers to the three questions posed by management. When performing CVP analysis, it is important to consider the accuracy of these simplifying assumptions. This results in an answer of the amount of monthly sales needed to achieve this profit. The formula to find the break-even point in sales dollars is as follows.

- The higher the percentage, the more of each sales dollar that is available to pay fixed costs.

- Fixed cost remains fixed at all levels of production in the short-run, but variable cost proportionately changes with the volume of output.

- And how should you price your goods in order to make a desired profit?

This conveys to business decision-makers the effects of changes in selling price, costs, and volume on profits (in the short term). CVP analysis is only reliable if costs are fixed within a specified production level. All units produced are assumed to be sold, and all fixed costs must be stable in CVP analysis. By using a special type of income statement that has been reformatted to group together your business’s fixed and variable costs.

Why You Can Trust Finance Strategists

Datarails integrates fragmented workbooks and data sources into one centralized location. This allows users to work in the comfort of Microsoft Excel with the support of a much more sophisticated but intuitive data management system. Being plugged into your financial reports ensures this valuable data is updated in real-time.

- The DOL number is an important number because it tells companies how net income changes in relation to changes in sales numbers.

- Cost-Volume-Profit Analysis (CVP analysis), also commonly referred to as Break-Even Analysis, is a way for companies to determine how changes in costs (both variable and fixed) and sales volume affect a company’s profit.

- The contribution margin per unit is the amount each unit sold contributes to (1) covering fixed costs and (2) increasing profit.

- Sensitivity analysis shows how the CVP model will change with changes in any of its variables (e.g., changes in fixed costs, variable costs, sales price, or sales mix).

- Finding the target profit in sales dollars for a company with multiple products or services is similar to finding the break-even point in sales dollars except that profit is no longer set to zero.

Through research, you discover that you can sell each sandwich for $5. The most common application of CVP by financial planning and analysis (FP&A) leaders is performing break-even analysis. Put most simply, break-even analysis is calculating how many sales it takes to pay for the cost of doing business reaching a breakeven point (neither making nor losing money).

If you add up all your variable costs for the accounting period, and divide by the number of units sold, you will arrive at the cost per unit. This cost should remain constant, regardless of how few or how many units you sell. For example, let’s say that XYZ Company from the previous example was considering investing in new equipment that would increase variable costs by $3 per unit but could decrease fixed costs by $30,000. In this decision-making scenario, companies can easily use the numbers from the CVP analysis to determine the best answer.

The break-even point (BEP), in units, is the number of products the company must sell to cover all production costs. Similarly, the break-even point in dollars is the amount of sales the company must generate to cover all production costs (variable and fixed costs). This includes that CVP analysts face challenges when identifying what should be considered a fixed cost and what should be classified as a variable cost. Once seemingly fixed costs, such as contractual agreements, taxes, rents can change over time. In addition, assumptions made surrounding the treatment of semi-variable costs could be inaccurate.

A high CM ratio and a low variable expense ratio indicate low levels of variable costs incurred. CVP Analysis can be used by managers to help them decide on pricing policies, output levels, cost control strategies, and capital investments. It provides important information about how changes in costs and other factors will affect profitability as well as helps managers identify breakeven points for budgeting purposes. In other words, the large widgets generate a higher

contribution margin per hour on the machine that constitutes the capacity

constraint of the factory.

CVP analysis endeavors to analyze the relationship between volume change and cost changes. Cost determines the selling price to be fixed for arriving at the desired level of profit; the selling price and quantity sold directly affect the volume of production, and cost depends on the volume of production. Cost categories that are typically included in a CVP analysis include fixed costs, variable costs, direct materials, direct labor, and overhead expenses.

It’s why the ice cream truck doesn’t charge $50,000 for the first ice cream cone it ever sells. More often than not, the total contribution margin is the number used for income statements. Cost-Volume-Profit (CVP) Analysis, also known as Break-even Analysis, is a way of understanding the relationship between a business costs, the volume of good or sales they need to make and any potential profit.